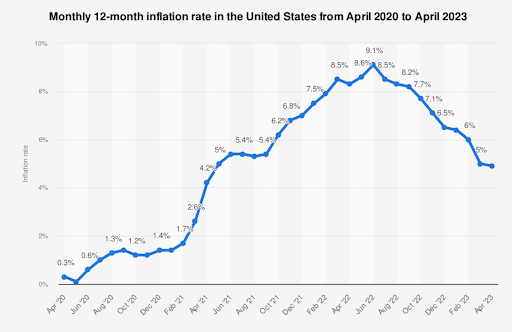

Inflation has been a hot topic in the news for most of 2024, and the last two months have brought significant changes affecting nearly every part of the economy. Inflation, which refers to the rise in prices for goods and services, has been a major concern since 2022 when it surged to its highest levels in four decades. This spike was driven by supply chain disruptions, rising energy costs, and, more recently, the economic impacts of global instability. For many, inflation has meant higher prices for everyday items like food, gas, and rent, making it harder to stretch a dollar.

Since September 2024, there have been some notable shifts in the inflationary landscape. The Consumer Price Index (CPI), a key indicator of inflation, has shown signs of slowing down, with inflation rates dipping slightly over the past two months. According to the latest data from the U.S. Bureau of Labor Statistics, the annual inflation rate decreased from 4.3% in September to 3.9% in November – a small but important drop. This change comes after months of aggressive interest rate hikes by the Federal Reserve, which have started to take effect. Higher interest rates make borrowing more expensive, which in turn slows down consumer spending and business investments, leading to lower demand and, eventually, lower inflation (U.S. Bureau of Labor Statistics).

When asked how the current state of our economy affects the everyday life of individuals in areas like ours, McKenna Houston, a current senior at Ramapo, said, “ Especially as I go into college this year, it has been emphasized to me more than ever to prioritize my financial stability and managing my money. I used to hear my dad complain about the gas prices and thought it was over-exaggerated, but now that I have to spend my own money on gas, I can certainly see where he came from. Ramapo is fortunate enough to have great resources to give us a proper education, however, I do realize that some are less fortunate and can barely afford to purchase groceries. I wouldn’t wish that on anyone.”

Similarly, Mr. Witterschein, an Economics teacher at Ramapo High School, wonders how “Trump’s new economic plan, like his high tariffs and even his deportation policy, will impact the economy. It’s possible that this could impact trade and prices could significantly increase.” When asked to make a broad prediction of what he thought inflation would look like in the next 2 years, he commented, “I expect our inflation to remain under control and that the economy will grow under this new economic plan.”

We’re all impacted by the effects of inflation, and staying informed helps all of us make better personal financial decisions and be prepared.